Trading Profit and Loss Account : Before preparing the balance sheet, a business must first produce a trade and profit and loss account. A business's net profit and gross profit can be determined with the help of trading and profit and loss records.

Trading Profit and Loss Account

Determining the income received or losses suffered during the accounting period is the goal of creating trade and profit and loss accounts.

- Trading Account

- Profit and Loss Account

The first portion of this account is the trading account, which is used to calculate the business's gross profit. The second portion of the account is the profit and loss account, which is used to calculate the business's net profit.

Give us more specific information about these accounts.

1. Trading Account

The gross profit or gross loss of a business resulting from trading activity is calculated using the trading account. The majority of trading activities are associated with the purchasing and selling processes that are part of a business. Businesses that deal in trading can benefit from trading accounts. They can quickly ascertain the business's total gross profit or loss thanks to this account. The sum thus calculated serves as a gauge for the business's purchasing and selling effectiveness.

The formulae for calculating gross profit are as follows:

Gross profit = Net sales – Cost of goods sold

Where

Net sales = Gross sales of the business minus sales returns, discounts, and allowances.

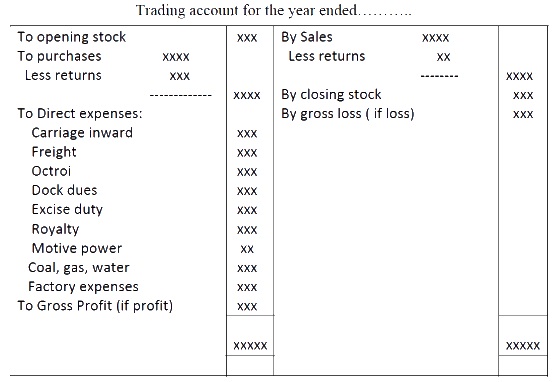

The credit side shows items like closing stock and sales, while the debit side shows items like purchases, opening stock, and direct expenses.

Closing entries for Gross Loss or Gross Profit

The following entries are passed

In the case of Gross Loss

Profit and Loss A/c Dr.

To Trading A/c

In the case of Gross Profit

Trading A/c Dr.

To Profit and Loss A/c

Preparing Trading Account

A closure journal entry is used to amend the inventory accounts and close any temporary purchase and revenue accounts to prepare the trading account.

Set up a trading account in preparation for the next query.

All of the accounts in this case are closed and moved to the trading account. The gross profit for the period is shown in the credit entry of $1,45,000.

2. Profit and Loss Account

The business's net profit and net loss for the accounting period are displayed in the profit and loss statement. The purpose of this account is to calculate the net profit or net loss incurred by a business entity for an accounting period.

Entering the gross profit on the credit side or the gross loss on the debit side opens the profit and loss account. This figure is derived from the trading account's balance that is carried down.

The following are some instances of costs that can be recorded in a profit and loss account:

- 1. Sales Tax

- 2. Maintenance

- 3. Depreciation

- 4. Administrative Expense

- 5. Selling and Distribution Expenses

- 6. Provisions

- 7. Freight and carriage on sales

- 8. Wages and Salaries

These are shown on the debit side of the profit and loss account, whereas the credit side shows the commission earned, the discount received, and the profit from the sale of assets.

By subtracting business expenses from gross profit and adding additional income received, net profit may be calculated.

Net profit = Gross profit – Expenses + Other income

Closing Entries for Net Loss or Net Profit:

i. In case of Net Loss

Capital A/c – Dr.

To Profit and Loss A/c

ii. In the case of Net Profit

Profit and Loss A/c -Dr.

To Capital A/c

Trading and Profit and Loss Account Format

Trading and Profit and Loss Account format is represented separately as follows:

Format for Trading Account

0 Comments